Boomerbenefits.com Reviews - The Facts

The Best Strategy To Use For Boomerbenefits Com Reviews

Table of ContentsBoomerbenefits.com Reviews - The FactsNot known Facts About Medicare Plan G JokeThe Facts About Medicare Plan G Joke RevealedNot known Facts About Attained Age Vs Issue AgeLittle Known Questions About Attained Age Vs Issue Age.

These changes were arranged to go into impact in October 2017, however have been delayed. Check out much more regarding them in this Justice in Aging Issue Quick on New Methods in Combating Improper Payment for QMBs (Feb. 2017). (by mail), also if they do not likewise obtain Medicaid. The card is the device for wellness care carriers to bill the QMB program for the Medicare deductibles and also co-pays.

Links to their webinars and also various other resources is at this link. Their information consists of: September 4, 2009, updated 6/20/20 by Valerie Bogart, NYLAG This article was authored by the Empire Justice Facility.

Get This Report about Aarp Medicare Supplement Plan F

Each state's Medicaid program pays the Medicare cost-sharing for QMB program members. Anybody that qualifies for the QMB program doesn't have to spend for Medicare cost-sharing and can not be charged by their healthcare companies. If an individual is thought about a QMB And also, they fulfill all criteria for the QMB program however likewise meet all monetary demands to get full Medicaid solutions.

The first action in enrollment for the QMB program is to locate out if you're qualified. You can ask for Medicaid to supply you with an application form or find a QMB program application from your state online.

There are instances in which states may limit the amount they pay health and wellness care suppliers for Medicare cost-sharing. Even if a state restricts the quantity they'll pay a supplier, QMB participants still do not need to pay Medicare service providers for their health care expenses as well as it protests the regulation for a service provider to inquire to pay - boomer benefits phone number.

A Medicare Benefit Unique Requirements Strategy for dual-eligible individuals might be an amazing choice. Generally, there is a costs for the strategy, yet the Medicaid program will pay that costs (medicare plan g joke). Lots of people select this extra protection due to the fact that it supplies regular oral and vision treatment, as well as some included a fitness center membership.

Examine This Report about Medicare Plan G Joke

Enter your postal code to draw strategy alternatives available in your area. Select which Medicare prepares you would like to compare in your area. Contrast prices alongside with plans & carriers offered in your area. Jagger Esch is the Medicare professional for Medicare, FAQ and also the owner, head of state, and chief executive officer of Elite Insurance Allies and also Medicare, FAQ.com.

He is included in many publications as well as creates routinely for various other expert columns relating to Medicare.

Numerous states enable this throughout the year, yet others restrict when you can register partially A. Bear in mind, states use various policies to count your revenue and properties to determine if you are eligible for an MSP. Examples of earnings include earnings as well as Social Security advantages you obtain. Examples of assets consist of checking accounts as well as stocks.

* Certified Handicapped Functioning Person (QDWI) is the fourth MSP and pays for the Medicare Part A premium. To be qualified for QDWI, you must: Be under age 65 Be functioning but continue to have a disabling disability Have limited revenue and also assets And, not currently be qualified for Medicaid.

Medigap Plan G Can Be Fun For Everyone

Bonus Aid covers points like: regular monthly premiumsdeductiblescopays for prescriptions, Some drug stores may still charge a tiny copay for prescriptions that are covered under Part D. For 2021, this copay is no more than $3. 70 for a common medicine as well as $9. 20 for each and every brand-name medicine that is covered. Additional Assist just uses to Medicare Component D.

MSPs, including the QMB program, are carried out via your state's Medicaid program. That suggests that your state will identify whether you certify. As an example, different states may have different ways to calculate your revenue and also sources. Let's analyze each of the QMB program eligibility criteria in even more detail listed below.

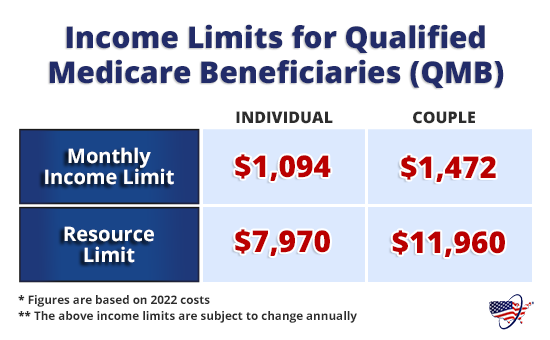

The month-to-month income limit for the QMB program raises annually. That suggests you ought to still use for the program, even if your earnings goes up a little. Resource limitations, Along with a monthly revenue limitation, there is additionally a source limitation for the QMB program. Products that are counted towards this restriction consist of: money you have in checking and savings accountsstocksbonds, Some resources do not count towards the resource restriction.

Not known Details About Boomerbenefits.com Reviews

, the source limitations for the QMB program are: $7,970 $11,960 Source limits also raise every year. As with earnings restrictions, you must still apply for the QMB program if your sources have actually slightly boosted.